Mastering Money Management: Teach Your Kids How to Spend and Save Wisely

Hey, awesome parents! Are you looking to turn those adorable little spenders into savvy savers? Well, buckle up because we’re about to embark on an exciting journey into the world of financial literacy for kids. Teaching your children how to manage money wisely is one of the most beneficial life skills you can impart, and it’s never too early or too late to start. Let’s dive into the wonderful world of spend vs. save – the kid-friendly version, of course!

The Whys of Wise Spending and Saving

Before we dive into the hows, let’s unwrap the whys. Understanding the value of money and the impact of their spending and saving choices can help your children build a solid foundation for their future financial health. With the right guidance, they’ll learn how to make smart decisions, prioritize needs over wants, and even develop a strong work ethic. Cool, right?

Building the Money Basics with Your Kids

When it comes to money management, the basics are like seeds that grow into a tree of knowledge. So, what’s the seed we’re planting today? Budgeting! Here’s a fun way to get started:

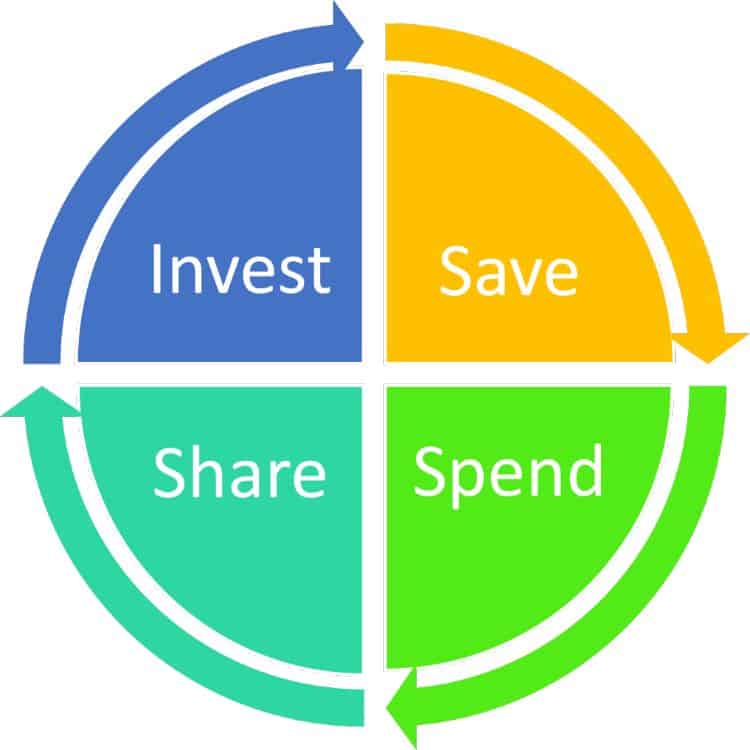

- Money Jars: Grab three jars and label them Spend, Save, and Share. Each time your child receives money, whether it’s allowance, birthday cash, or tooth fairy treasure, help them divide it among the jars. This tactile experience is great for youngsters to understand budgeting.

- Needs vs. Wants: This is a prime concept! Draw a two-column chart and ask your kids to draw or write down things they need (like food and shelter) and things they want (that latest video game or toy). Discuss the difference and why it’s important to fulfill needs before wants.

Age-Appropriate Lessons on Spending and Saving

Financial lessons aren’t one-size-fits-all. They should grow with your child. Here’s a quick breakdown:

- Kiddie Consumers (Ages 3-5): For the littlest learners, keep it simple. Use a clear jar for saving so they can see their money grow. Turn shopping into a learning game by allowing them to hand over money at the cash register, helping them understand the exchange process.

- Budding Bankers (Ages 6-10): It’s time to introduce the concept of opportunity cost. If they buy that toy today, they might not have enough for a movie ticket next week. Encourage them to think about the consequences of their spending choices.

- Pre-Teen Treasurers (Ages 11-13): Boost their financial vocabulary with terms like “interest” and “savings account.” It could be the perfect time to open their first savings account and watch their money earn interest over time. How cool is that?

Remember, dear parents, teaching your kids about spending and saving isn’t a crash course; it’s a journey you embark on together. And the best part? By investing time in their financial education now, you’re empowering them with tools for a lifetime of success.

Stay tuned as we continue this adventure with more in-depth tips on how saving can be super fun and incredibly rewarding, and how wise spending isn’t just about what you buy, but also about the value you get for your hard-earned cash. It’s all about making those financial lessons stick in the most delightful way possible. Let’s make money matter!

Get ready for your child’s future to look as bright as their smiles when they realize that they’re becoming money maestros before they even hit high school!

5 Essential Tips for Parents: Preparing Kids for Financial Savvy

Hello, wonderful parents! Want to help your munchkins morph into financial geniuses? You’re in the perfect place! As we continue our journey on teaching kids about money management, we’re zooming in on preparing them for a future where they not only have dollars in their piggy banks but also wise money habits in their repertoire. So, let’s leap into five fabulous tips that will help set the stage for your little ones to become pros at spending and saving!

1. Start with a Story: Money Tales That Teach

Begin the learning process with something all kids love – stories! Whether it’s the classic tale of the “Ant and the Grasshopper” or a modern narrative like “Alexander, Who Used to Be Rich Last Sunday,” use engaging stories to highlight the importance of saving and the potential consequences of thoughtless spending. Storytime can be financial lesson time without the eyerolls!

2. Lead by Example: Show Them How It’s Done

Kids are like sponges – they soak up behaviors they see. Let them watch you budget, shop with a list, and save towards your goals. Share your financial decision-making with them, “I’m choosing to buy this brand because it’s more cost-effective,” or “We’re saving up for a family vacation instead of eating out.” Watching you can teach them loads about careful spending and saving.

3. Make It a Family Affair: Collaborative Money Habits

Money management isn’t a solo mission – it’s a family voyage! Set family financial goals, like saving for a new game or a beach outing. Have regular family finance meet-ups to track progress. It’s amazing how a shared objective can turn abstract concepts into concrete lessons that resonate with your kids.

4. Introduce Financial Tools: Banks and Apps

As your children grow, introduce them to banking tools. Set up a savings account and let them interact with banking apps under your supervision. Today’s digital world has countless kid-friendly financial apps that gamify saving and budgeting – this not only teaches them about money but does so in a language they understand and enjoy!

5. Reward Efforts: Celebrate Saving Successes

Recognize and reward your child’s saving triumphs. When they reach a savings goal, make a big deal out of it! It doesn’t have to be material – a celebratory dance or a day out in their honor works wonders. Positive reinforcement makes financial responsibility something they will want to continue.

Equipping your children with financial smarts is one of the greatest gifts you can give. Not only does it prepare them for the tall ladder of life, but it also instills in them an invaluable sense of independence and confidence that comes from mastering money management!

Embrace these tips and watch your kiddos transform from little spenders to big savers, and from there, into money-management superstars. The road ahead is bright, and your guidance is their compass on the thrilling adventure to financial savvy!

Ready, set, let’s raise a generation of financial wizards, who understand the language of money as fluently as they do their favorite video games. Together, we can create a future where ‘money troubles’ are a thing of the past for our children.

See more great Things to Do with Kids in New Zealand here. For more information see here

Disclaimer

The articles available via our website provide general information only and we strongly urge readers to exercise caution and conduct their own thorough research and fact-checking. The information presented should not be taken as absolute truth, and, to the maximum extent permitted by law, we will not be held liable for any inaccuracies or errors in the content. It is essential for individuals to independently verify and validate the information before making any decisions or taking any actions based on the articles.