A Comprehensive Guide for Parents: Understanding Bonus Bonds NZ

Hello there, wonderful parents of New Zealand! ? Are you looking for a smart and potentially rewarding way to save for your child’s future? You’ve probably heard about Bonus Bonds, and you’re curious to see if they’re a good fit for your family’s financial planning. Well, you’ve come to the perfect place! This guide is designed to unwrap the mystery of Bonus Bonds and help you decide whether they’re the right choice for your little one’s nest egg. So, let’s dive in!

What Are Bonus Bonds and How Do They Work?

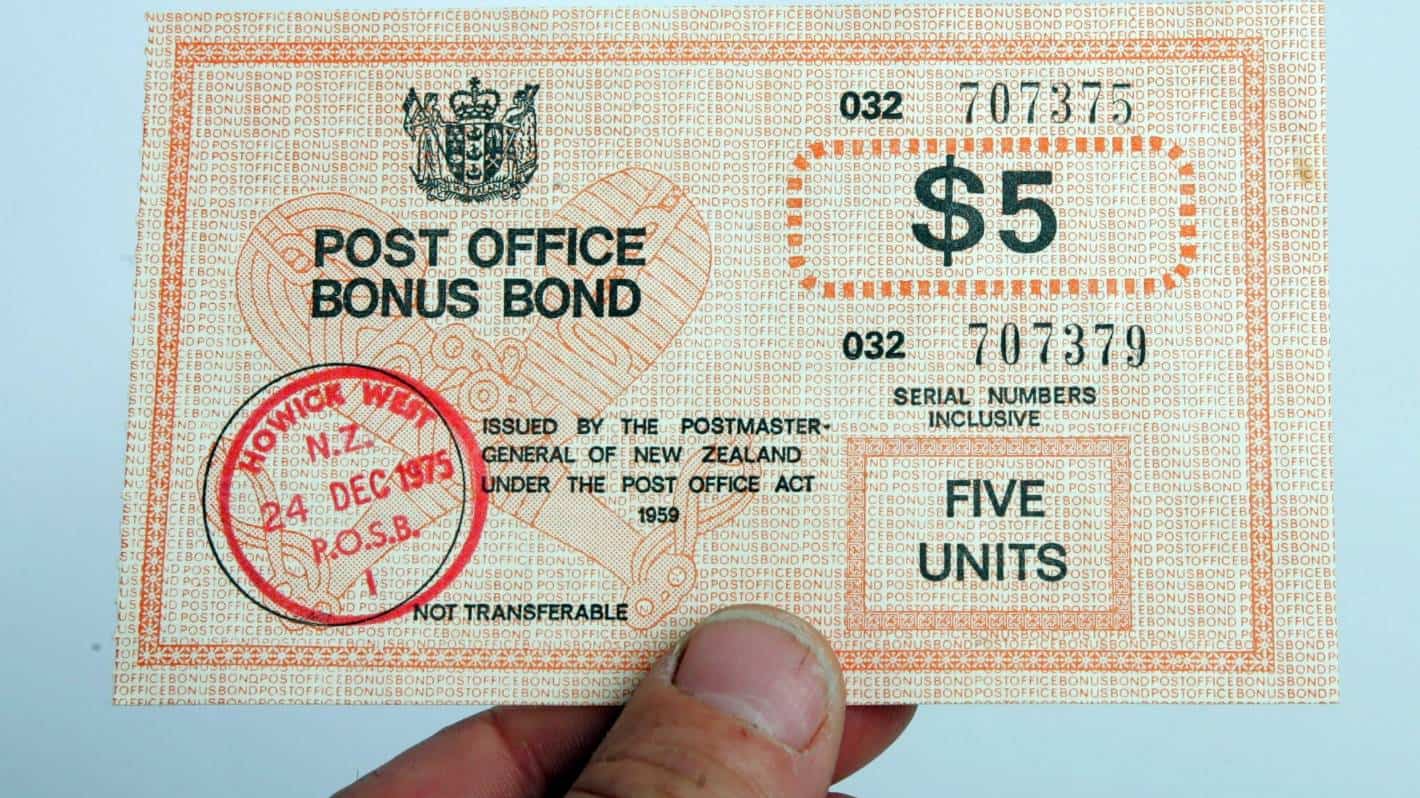

Bonus Bonds have been a unique form of investment in New Zealand for many years. Think of Bonus Bonds as a savings scheme with a twist – instead of earning interest or dividends like other investments, they give bondholders the chance to win cash prizes in regular monthly draws. It’s like having a lottery ticket that never expires as long as you hold onto your bonds!

When you purchase Bonus Bonds, each bond is assigned a unique number that is entered into the monthly prize draw. These numbers then have potential to win prizes, which can be as large as a million dollars! Thus, not only do you save your money, but you also get the thrill of participating in a draw each month.

The History of Bonus Bonds in New Zealand

Bonus Bonds have a storied history in New Zealand, having been introduced in the 1970s. Initially managed by the government as a way to encourage savings, the scheme has since evolved. However, it’s essential to note that the Bonus Bonds scheme is continually subject to change, including its operations and the frequency of the prize draws. It is crucial for potential investors to stay informed about these developments.

Are Bonus Bonds Still Available?

With the changing financial landscape and investment strategies, it’s important to note that as of late 2020, the Bonus Bonds scheme has been put on pause, and no new bonds are being sold. However, many New Zealand families still hold Bonus Bonds, and the intricates of the operation remain relevant and valuable knowledge.

What Are the Pros and Cons of Bonus Bonds?

Before we jump right into the details, let’s weigh the pros and cons. Here’s a quick breakdown:

- Pros:

- Chance to win large cash prizes every month.

- Capital security since Bonus Bonds can always be cashed in for their original purchase price.

- No fixed term – you can cash in your bonds at any time.

- Can be a fun way to engage children with saving and finances.

- Cons:

- No regular interest or dividend payments, which means your investment may not keep up with inflation.

- Not currently available for new purchases.

- Prizes are awarded by chance, so returns are not guaranteed.

- May not be suitable for those seeking a regular income from their investment.

With these points in mind, let’s take a closer look at what makes Bonus Bonds tick, and how they can fit into your family’s financial future. After all, informed investing is the best kind of investing! ?

Stay right there! The following sections of this guide will provide even more insights into Bonus Bonds NZ, including eligibility, how to manage your bonds, tax implications, and alternative investment options. Plus, we’ll sprinkle in some savvy tips to ensure your family is making the most out of your investment options. So keep reading, and let’s get finance-savvy together! ?

Note: Information provided in this guide is based on the status of Bonus Bonds as of March 2023. It’s always best to consult with a financial advisor before making investment decisions for the most up-to-date advice tailored to your personal circumstances.

Understanding your investment options is like embarking on an adventure, and we’re thrilled to be your trusty guide on this journey. Buckle up, as we explore the charming world of Bonus Bonds and more in the realm of smart saving for your family!

Five Things Parents Should Know in Preparing for Bonus Bonds NZ

1. Eligibility and Buying into the Scheme

While new purchases of Bonus Bonds are currently on hold, it’s advantageous to understand who can hold Bonus Bonds. They are available to New Zealand residents of all ages. This inclusivity means you could hold bonds in your own name or invest on behalf of your children. But remember, if you’re looking to secure Bonus Bonds as a future investment, it’s worth keeping an eye on announcements from ANZ, the managing institution, about the status of the scheme.

2. Managing Existing Bonus Bonds

If you’re already equipped with Bonus Bonds, managing them well is crucial. They can be managed online through the MyBonusBonds platform. Here, you can check your bond balance, and if lady luck has smiled upon you, winnings can, generally, be re-invested into additional bonds or withdrawn. However, the specifics around this could evolve, so staying updated on the scheme’s terms is important.

3. Tax Implications

A sunny day for parents – Bonus Bonds prize winnings are tax-free in New Zealand! This is great news as you don’t have to worry about a chunk of your potential winnings being snipped away by taxes. Instead, any prizes won are yours to keep in full, making them an attractive proposition for those looking for a simple and fun way to possibly grow their savings.

4. Long-Term Returns and Effects of Inflation

When the world turns and prices go up, the money you’ve saved can end up buying you less. This is inflation at work. Bonus Bonds do not offer routine interest payments, meaning the value of your investment might not keep pace with inflation over time. This could decrease the purchasing power of your initial investment, important to bear in mind for your long-term saving goals.

5. Alternatives to Bonus Bonds

If you’re exploring options other than Bonus Bonds for your children’s future, there are plenty of buckets where you can sprinkle your money seeds. Term deposits, KiwiSaver, education funds, or managed investment funds are all alternatives with different levels of risk and potential return. It could be wise to splash into a few ponds, diversifying your investments to balance potential gains with security.

So, there you have it! Whether Bonus Bonds are part of your financial tapestry or you’re exploring different avenues, understanding the landscape helps you make the best decisions for your family’s financial wellbeing. Navigating the twists and turns of investment options can bring you closer to the future you’re dreaming of for your children, so stay curious, keep learning, and be ever so excited about the possibilities! ?

Understanding your investment options is like embarking on an adventure, and we’re thrilled to be your trusty guide on this journey. Buckle up, as we explore the charming world of Bonus Bonds and more in the realm of smart saving for your family!

See more great Things to Do with Kids in New Zealand here. For more information see here

Disclaimer

The articles available via our website provide general information only and we strongly urge readers to exercise caution and conduct their own thorough research and fact-checking. The information presented should not be taken as absolute truth, and, to the maximum extent permitted by law, we will not be held liable for any inaccuracies or errors in the content. It is essential for individuals to independently verify and validate the information before making any decisions or taking any actions based on the articles.