Hey there, super-parents of New Zealand! Are you ready to dive into the world of tax refunds and discover some delightful ways to maximize your benefits? Let’s embark on this journey together to make tax time a breeze! First things first, let’s get to grips with what a tax refund is. In Aotearoa, a tax refund occurs when the amount of tax you’ve paid throughout the financial year exceeds the amount you were supposed to pay. Simply put, it’s like finding extra coins in your pocket – except these coins can significantly boost your family’s budget! Now, eligibility often feels like a maze, but not to worry! We’re here to shine a light on who can claim a tax refund. If you’ve been working, making donations, or have been involved in other activities that tax has been deducted from, you may have a lovely refund waiting for you. Eligibility for a tax refund can seem confusing, but let’s clarify it with some simple checkpoints: If you’ve nodded yes to any of these, you could be in for a good surprise when tax season comes around! Roll up your sleeves, because we’re digging into the nitty-gritty of claiming your tax refund: Before battling the tax refund dragon, arm yourself with these essentials: Using the wrong tax code is like wearing mismatched socks – uncomfortable and a bit embarrassing. Ensure your tax code matches your situation to avoid any hiccups. As a parent, you might not just be caring for your own tax affairs but also those of your little ones. Whether it’s their first job or their part-time earnings, you can help ensure they’re on the right track for a future refund, too! Now, for some really exciting news – as parents in NZ, you may be eligible for a range of family tax credits and benefits. These can offer significant financial support and, in turn, boost your overall tax refund. We’ll delve into the Working for Families scheme and other cool perks that come with the territory of parenting!

Ultimate Guide to Tax Refunds in NZ for Parents: Maximise Your Benefits!

Understanding Tax Refunds: The Basics

Are You Eligible for a Tax Refund?

Your Step-by-Step Guide to Claiming Your Tax Refund

Step 1: Gather Your Information

Step 2: Check Your Tax Code

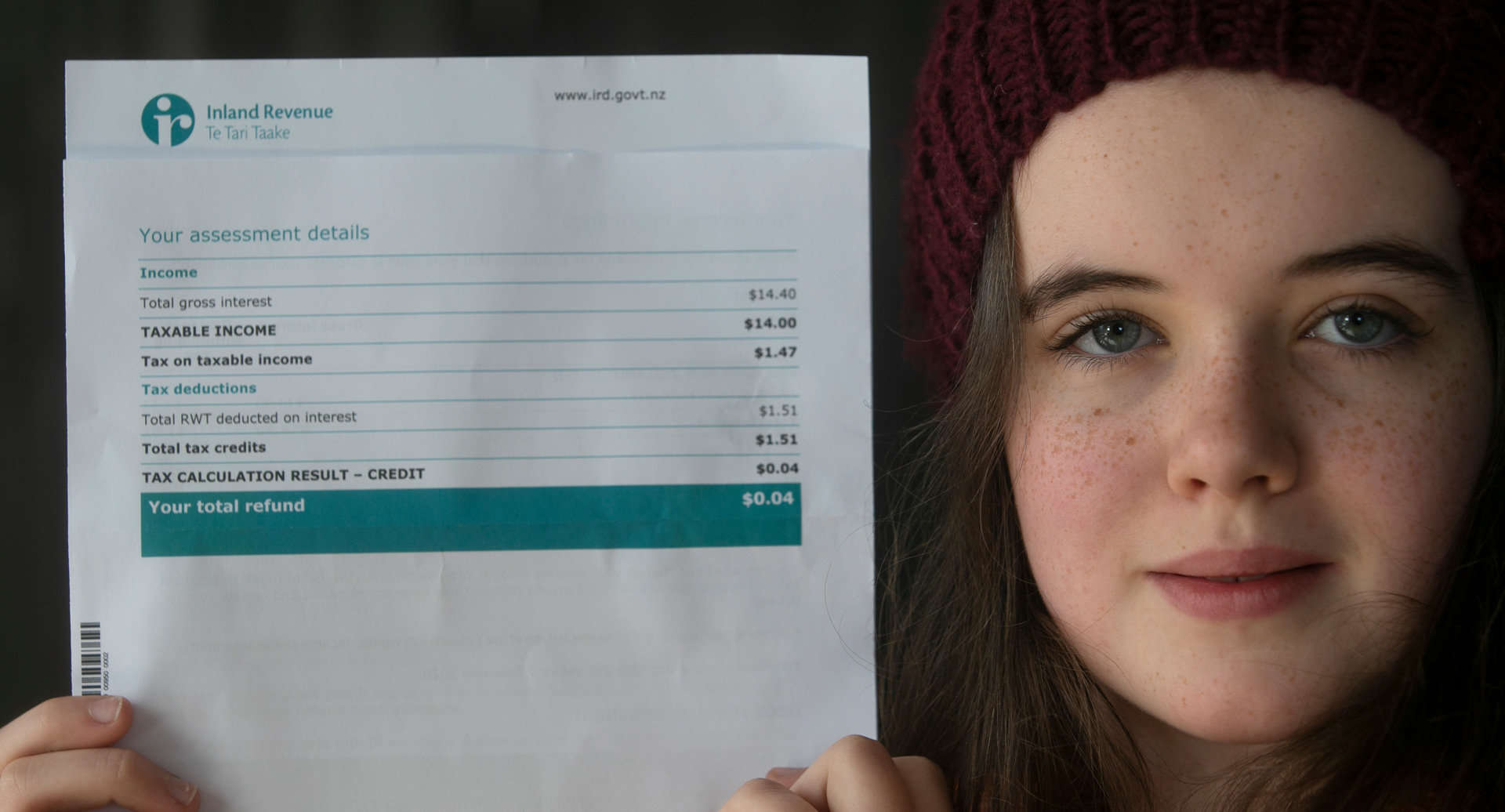

Claiming for the Kidlets: What Parents Need to Know

Utilizing Family Tax Credits and Benefits

Discovering Family Tax Credits and Benefits for Extra Joy

Ready to turn tax time into a bounty of benefits? New Zealand offers a treasure trove of family tax credits and benefits that can help stretch your household budget. Here’s the scoop on what’s available:

Working for Families Tax Credits

The Working for Families Tax Credits are like a financial high-five for parents! If you’re working and raising kiddos, you could be eligible for this package of credits, including:

- Family Tax Credit – a weekly payment to help with the costs of raising children.

- In-Work Tax Credit – a boost for families who meet the work hours requirements.

- Minimum Family Tax Credit – ensures a minimum annual income for families who work the required hours.

- Best Start – extra support during the early years of your little one’s life.

Parental Tax Credit

Welcoming a new member into the family? The Parental Tax Credit might be for you! This credit is designed to help during the first 10 weeks after your baby’s birth, making those initial sleep-deprived weeks a bit lighter on the wallet.

It’s important to note that specific criteria apply, and some credits cannot be claimed together, so do your homework to understand what mix works best for your family.

Fab Five Tips For Parents Preparing for Tax Refund in NZ

Let’s get you prepped and ready for tax refund success! Here are five things every parent should know:

Know Your Deadlines

Mark the calendar! Keeping up with deadlines is crucial to ensure you don’t miss out on your refund. The New Zealand tax year ends on 31 March, and you’ll typically have until 7 July to file your tax return.

Get Your Documents in Order

Gather payslips, receipts, and donation records. Organised paperwork means a smoother process and can help you identify all the deductions and credits you’re entitled to.

Understand Your Entitlements

Make sure you’re aware of all the credits and benefits you qualify for. Check the IRD website or consult with a tax professional to leave no stone unturned!

Consider Childcare Expenses

If you’ve been paying for childcare, you may be able to claim a portion of those expenses. Keep your receipts and check for eligibility – it could give your refund a nice little lift!

Double-Check Everything

Errors can delay your refund or result in a smaller payout. Take the time to review your return for any mistakes before you submit it.

See more great Things to Do with Kids in New Zealand here. For more information see here

Disclaimer

The articles available via our website provide general information only and we strongly urge readers to exercise caution and conduct their own thorough research and fact-checking. The information presented should not be taken as absolute truth, and, to the maximum extent permitted by law, we will not be held liable for any inaccuracies or errors in the content. It is essential for individuals to independently verify and validate the information before making any decisions or taking any actions based on the articles.