Welcome to Your Guide on Parenting Single Payment

What Is Parenting Single Payment?

Are you juggling the responsibilities of being a loving parent while trying to manage your finances single-handedly? Fear not, because understanding the ins and outs of Parenting Single Payment can take a load off your shoulders! Let’s get you acquainted with this financial concept that is crucial for parents who might be facing the ups and downs of single parenthood or simply looking for ways to streamline their family’s financial management.

Why This Guide Can Help You?

Whether you’re a seasoned single parent, newly navigating the financial landscape after a change in your family dynamic, or a couple planning for the future, this guide is here to enlighten you about parenting single payments. It’s not just about receiving a lump sum; it’s about meticulous budgeting, understanding eligible entitlements, and making savvy financial decisions that can benefit your family in the long run.

Streamlining Your Finances as a Parent

Navigating your finances as a parent can sometimes feel like threading a needle while riding a roller coaster—it’s tricky! But with our comprehensive guide, we’ll provide you with the sweet strategies and delightful tips to streamline your parenting single payment. This way, you can spend less time worrying about money and more time enjoying the precious moments with your little ones.

Eligibility for Parenting Single Payment

First things first, let’s explore who is eligible for the parenting single payment. It’s a special form of financial aid designed to support single parents or guardians in raising their children. Depending on where you reside, the criteria can vary, but typically, it entails being the primary caregiver and meeting certain income, residency, and custody requirements.

Application Process Simplified

Applying for your parenting single payment doesn’t have to be daunting. We’ll walk you through the process step by delightful step, making sure you have all the necessary documents at your fingertips and understand the timelines involved. Our aim is to transform this seemingly complex task into a breeze!

Maximizing Your Payment

Once you secure your parenting single payment, the next adventure is maximizing its potential. We’ll provide fabulous financial planning tips so that every penny from your payment is put to good use. From covering the basics like housing and groceries to planning for future education costs, we’ve got hacks that’ll make every dollar stretch with a smile.

Budgeting Tips for Single Parents

Here’s where we roll up our sleeves and dive deep into the joyful world of budgeting. As a parent managing funds on your own, a well-structured budget is your best friend. It’ll guide you in prioritizing expenses, avoiding common pitfalls, and setting a radiant example for your children about the value of money.

Expert Advice

In our guide, you will also find wisdom from financial experts who have a soft spot for helping parents thrive. They’ll offer their seasoned advice on managing your single payment, how to invest in your child’s future securely, and even navigating the emotional aspects that money can bring into family dynamics.

The Journey Forward

Preparing for the journey of managing your parenting single payment is like packing a picnic for a sunny day at the park. With a bit of preparation and our helpful insights, you’ll be ready to spread out your financial blanket with confidence.

Let’s Get Started!

Ready to tackle your finances with joy and ease? Keep reading our guide, and you’ll be well on your way to becoming a pro at managing your parenting single payment. Together, let’s turn the page towards brighter financial skies for you and your little stars!

Five Essential Things Parents Should Know in Preparing for Parenting Single Payment

1. Understand the Payment Structure

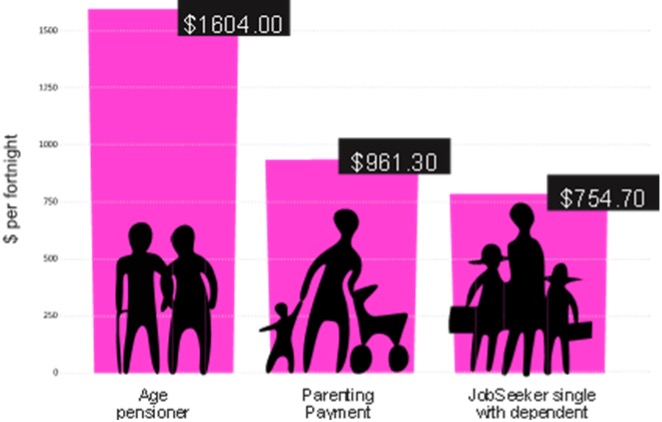

Parenting single payment systems vary by region but typically, they involve either a lump-sum or regular installments. Get to know the payment frequency, structure, and method of your specific program. Whether it comes weekly, fortnightly, or monthly, grasping the schedule will help you tailor your budget accordingly and dodge any financial surprises.

2. Know Your Entitlements

Familiarize yourself with the entitlements that come with the parenting single payment. Some schemes might offer additional benefits or subsidies like healthcare, education grants, or discounts on utilities. Ensure that you’re applying for all the relevant perks to maximize the support you receive for your family’s well-being.

3. Prepare Your Documentation

To ensure a smooth application process, gathering and preparing your documentation is key. This typically involves income statements, identification for you and your children, and any relevant custody paperwork. Having these documents in order reduces the likelihood of delays or hiccups during the application or reevaluation processes.

4. Create a Financial Plan

Once you know the payment amount and frequency, develop a financial plan that aligns with your family’s needs and goals. Allocate funds to necessities such as housing, food, and education first. Consider setting aside portions for savings or emergency funds to build financial resilience.

5. Seek Professional Advice

When in doubt, don’t hesitate to seek professional financial advice. This can be particularly impactful if you’re unsure about how to best structure your budget or invest portions of your payment. Professionals can offer personalized guidance tailored to your specific situation, ensuring that you make the most out of your parenting single payment.

Conclusion

As we wrap up this section of our guide, remember that the key to successfully managing your parenting single payment lies in understanding the system, being prepared, and confidently making informed financial decisions. Embrace the support that these payments offer, and use them as a foundation to build a secure and happy future for you and your children.

For more great articles please see here. For more information see here

Disclaimer

The articles available via our website provide general information only and we strongly urge readers to exercise caution and conduct their own thorough research and fact-checking. The information presented should not be taken as absolute truth, and, to the maximum extent permitted by law, we will not be held liable for any inaccuracies or errors in the content. It is essential for individuals to independently verify and validate the information before making any decisions or taking any actions based on the articles.