Unlocking Financial Wisdom: A Comprehensive PocketSmith Review for Parents

Hey there, incredible parents! Are you on the lookout for a reliable financial assistant to help manage your family’s budget better? Look no further! Today, we are going to dive deep into a tool that might just be what your family needs to achieve financial clarity and freedom. It’s time to explore what PocketSmith has in store for you, and how it can make managing those dollars and cents as seamless as ABC.

PocketSmith is a robust personal finance software that has been earning rave reviews for its detailed budgeting and forecasting features. If you’re juggling the finances of a busy household, getting a transparent overview of your money can be a game-changer. So, buckle up as we take you through an extensive review of PocketSmith, with a lens on its suitability for families and parents.

Why PocketSmith is a Hit Among Parents

PocketSmith shines in various aspects that appeal especially to parents. Whether it’s the user-friendly interface or the ability to forecast up to 10 years into the future, PocketSmith has made a name for itself as a valuable tool for family budgeting. But hey, don’t just take our word for it; let’s investigate why it’s a smart pick for household financial management.

- Easy Synchronization: With PocketSmith, you can sync your bank accounts, credit cards, loans, and even investment accounts in one place. This means no more switching between apps or scratching your head over forgotten transactions.

- Planning for the Future: This platform takes the guessing game out of your financial planning. With its detailed forecasting abilities, you can see how buying that new family car or saving for college could affect your finances years down the line.

- Stay On Top of Every Penny: PocketSmith’s super handy categorization feature helps you track exactly where your money is going. Diapers, dance lessons, family treats – they all get their own category, so you can see how each expense affects your budget.

- Set and Achieve Goals: Whether it’s setting up an emergency fund or saving for your kid’s braces, PocketSmith allows you to set and track your financial goals, giving you a clear roadmap to success.

Features That Make Budgeting a Breeze

What truly sets PocketSmith apart are its features that cater to a wide array of financial tasks.

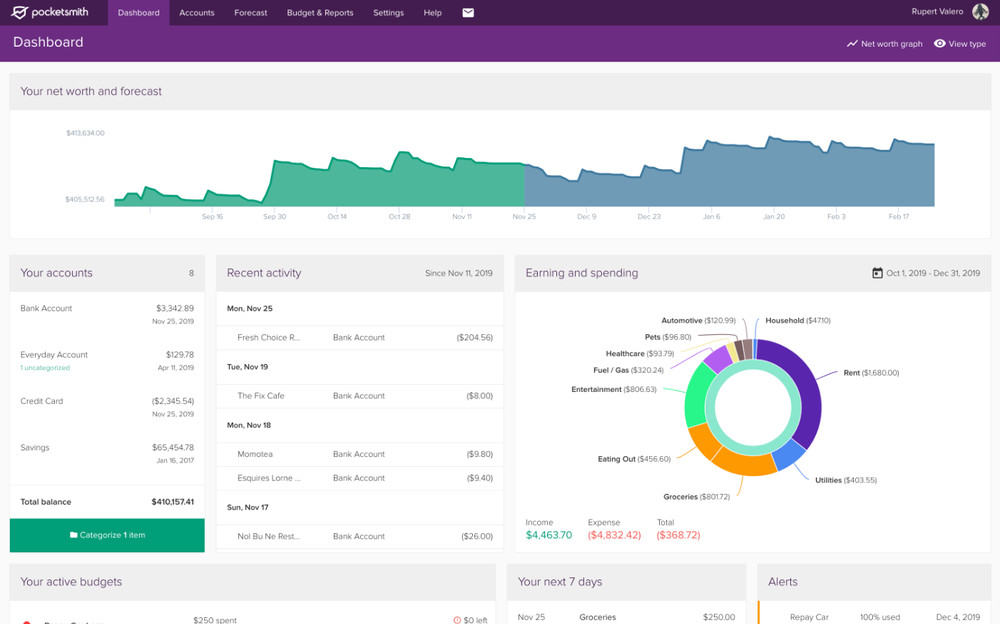

- Dashboard Overview: Get an instant snapshot of your current financial situation right when you log in. From net worth to upcoming bills, it’s all there in front of your eyes.

- Budget Calendar: Visualize your spending with a calendar that helps you stay on top of bills and plan out your spending days or weeks in advance.

- What-If Scenarios: Contemplating a big purchase? Test out “what-if” scenarios to see how these decisions can impact your budget in the long run.

- Mobile App Accessibility: With apps for iOS and Android, you can check your budget on the go, making it easier than ever to maintain financial control wherever you are.

Security at its Core

Before diving into any financial tool, security is paramount. PocketSmith employs ‘bank-level’ security protocols, ensuring that all your sensitive financial information is guarded like Fort Knox. Peace of mind comes standard with data encryption, and the reassurance that PocketSmith does not sell your data to third parties.

As you consider incorporating PocketSmith into your financial planning, know that it isn’t just about software but adopting a healthier financial lifestyle for you and your family. The next section will delve into the nitty-gritty of making PocketSmith work for you, including the few drawbacks it has and how to navigate them.

Now that we’ve covered the basics of what makes PocketSmith a potential ally for parents in their financial journey, let’s keep moving. There’s a treasure trove of information up ahead, and we’re excited to help you unlock the full potential of PocketSmith for your family’s financial wellbeing.

Stay with us, as next we’ll explore user experiences, compare cost plans, and offer tips on maximizing the value that PocketSmith offers – all to ensure you make the most informed decision for managing your family finances.

5 Essential Tips for Parents Preparing for PocketSmith

Transitioning to a new financial management tool can feel daunting. Here’s what you need to know to ensure your journey with PocketSmith is as smooth as possible:

- Gather Your Financial Details: Compile all your financial accounts, including bank accounts, credit cards, loans, and investments. Having this information ready will streamline the setup process.

- Hold a Family Budget Meeting: Involve your partner and older children in the budgeting process. Discuss goals, responsibilities, and how you all can contribute to the family’s financial health.

- Understand the Pricing Structure: PocketSmith offers different plans, including a free version with basic functionalities. Evaluate your family’s needs to decide which plan is the best match for your budgeting objectives.

- Dedicate Time to Learn the Platform: PocketSmith has various features and tools at your disposal. Set aside time to familiarize yourself with the interface and functionalities to maximize the benefits.

- Utilize Customer Support and Resources: Take advantage of PocketSmith’s customer support, user guides, and tutorials. These resources can hasten your learning curve and clarify any questions you may have.

The User Experience: Navigating PocketSmith as a Parent

Parents have unique needs when it comes to budgeting. Tailored categories for child-related expenses, setting up savings for future education costs, and managing day-to-day spending are just the tip of the iceberg. User reviews often highlight PocketSmith’s ability to customize and adapt to such intricate financial landscapes.

Usability comes front and center with users appreciating the straightforward navigation and intuitive design. Parents also value the peace of mind that comes from knowing they’re on track with their financial goals, and they credit PocketSmith for playing a significant role in this reassurance.

Comparing PocketSmith Plans: Which is Right for Your Family?

Identifying the right plan is crucial. The free tier gives you a taste of PocketSmith’s functionality, while premium plans offer advanced features:

| Features | Free | Premium | Super |

|---|---|---|---|

| Automatic Bank Feeds | No | Yes | Yes |

| Financial Forecasting | 6 Months | 10 Years | 30 Years |

| Budget Calendars | Limited | Unlimited | Unlimited |

Consider the premium plans if you value automatic transaction importing and more extensive forecasting. However, if you’re just getting started or have a simpler set of financial management needs, the free plan might suffice.

Maximizing the Value of PocketSmith for Your Family

To get the best out of PocketSmith, remain proactive about monitoring and categorizing your transactions. Regular reviews of your financial dashboards can help you stay ahead of your budget and promptly adjust as needed. Also, involve your family in tracking progress towards your financial goals, making it a collaborative and educational experience.

Keep in mind that while PocketSmith has comprehensive features, it may have a learning curve. Don’t hesitate to recalibrate your settings as you better understand your family’s financial flow within the tool. As you consistently use PocketSmith, your financial insight and control will grow, allowing you to plan with confidence for your family’s future.

Remember, the key to financial mastery is not just in the tool itself but in your dedication to using it effectively. With PocketSmith, you’re well-equipped with a platform that can evolve with your family’s changing financial needs.

Embrace the journey of financial organization with PocketSmith, where every dollar is accounted for, and every financial decision is made with clarity. Continue building a secure financial foundation for your family with this modern, adaptable, and user-friendly budgeting companion.

See more great Things to Do with Kids in New Zealand here. For more information see here

Disclaimer

The articles available via our website provide general information only and we strongly urge readers to exercise caution and conduct their own thorough research and fact-checking. The information presented should not be taken as absolute truth, and, to the maximum extent permitted by law, we will not be held liable for any inaccuracies or errors in the content. It is essential for individuals to independently verify and validate the information before making any decisions or taking any actions based on the articles.