Imagine, saving and investing every time you spend! Well you can, and that’s what I love about the Raiz App. With roundups on everything I spend automatically debited to my Raiz App Account, plus awesome rewards partners that give me cash back into my Raiz App Account, all then invested on my behalf, I totally love that I am saving and investing every time I spend. Best of all not only is Raiz free to join, if you join using this link they will put $5 into your account so you can start micro investing straightaway.

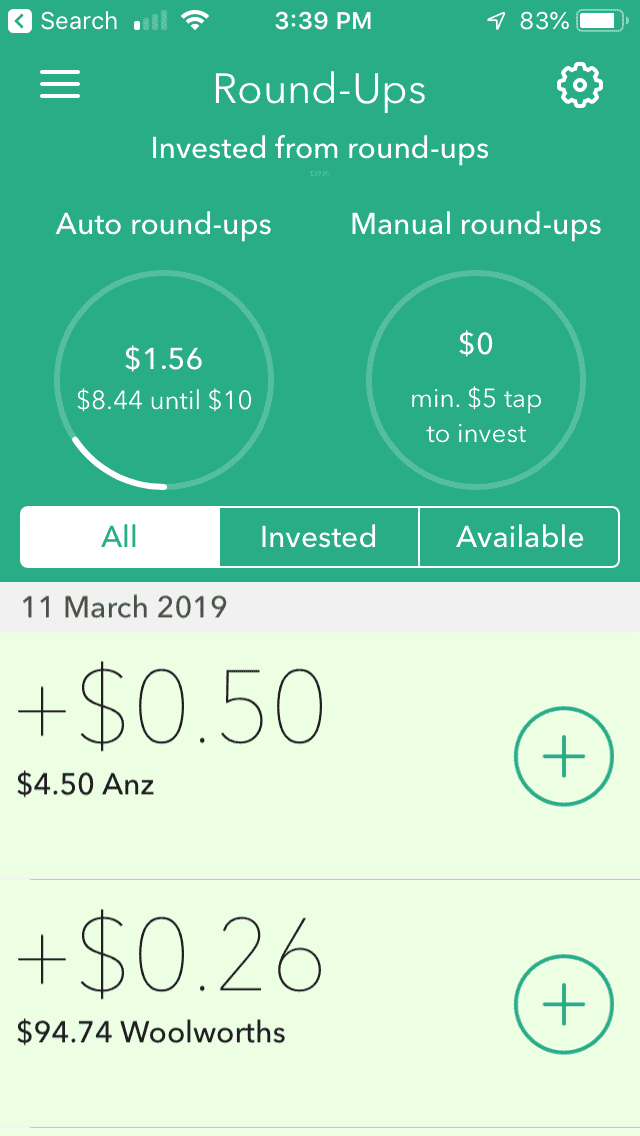

I’ve set my Raiz App to link to my transaction account and automatically transfer the rounds ups from everything that I spend (ie if I spend 4.50 on a coffee, 50c goes into my Raiz App) when the round ups get to $10.

I can also set up an automatic monthly savings amount to top up my account as an option. Round ups can be adjusted or stopped at any time using your Raiz App.

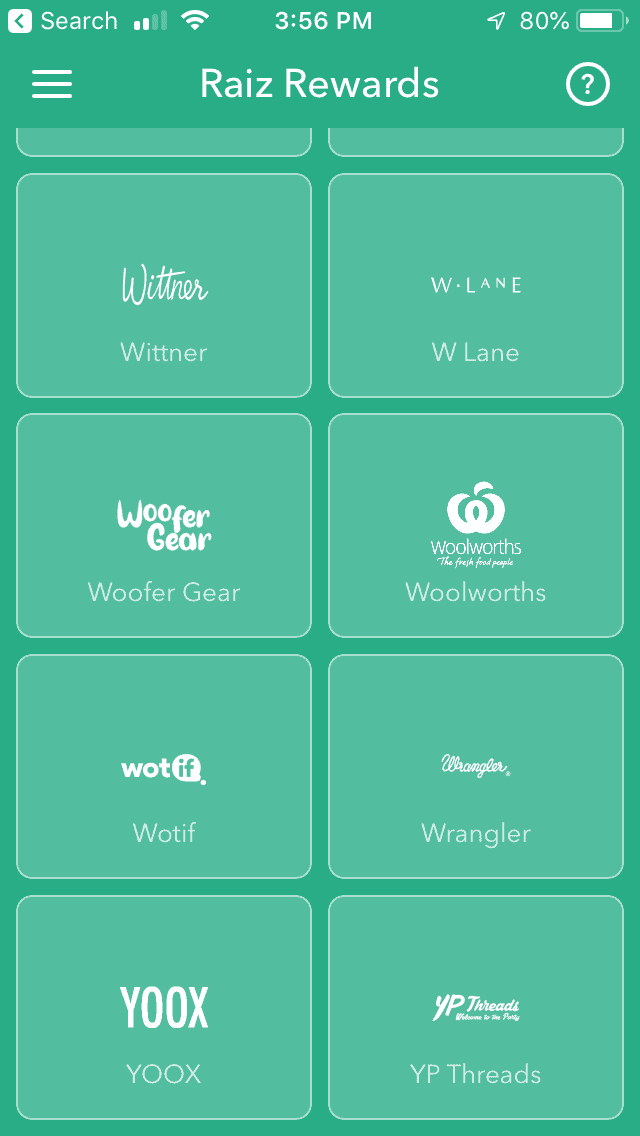

Raiz also has a range of reward partners, so if I spend with these partners through the app, a percentage or flat amount is rewarded into my Raiz App Account to be invested. Here are some of my favourites and some you may be spending with already.

- Woolworths 1.75% on a minimum spend of $30 back into you Raiz Account – perfect if you already order your groceries from Woolworths online

- Virgin Australia 1% of any flight booked back into your Raiz Account

- Booking.com 4.2% of your purchase price back into your Raiz Account once you have completed your stay

- Groupon 2.5% of your purchase back into your Raiz Account

- Discounted cinema tickets with up to $4 invested back into our Raiz Account

- Telstra mobile $105 for 24m plans and $52.50 for 12m plans back into your Raiz Account

Also Adidas, Apple, City Beach, Converse, Cotton On, Emirates, The Good Guys, Hello Fresh, Menu Log, Uber Eats, Uber, Pet Stock, The Body Shop, Travel Insurance Direct, Under Armour and many more.

Recently Raiz introduced E-Vouchers for retailers such as Woolworths, Big W, Myer, Rebel, JB HiFI, Priceline, Caltex and more. You receive up to 3% back into your Raiz account and the e-vouchers are delivered instantly into your ewallet and email, so you can purchase them while you are in line to pay for your petrol, groceries or gifts, or gift them to that someone special via email (perfect for if you have left their gift until the last minute and find yourself on a Sunday with no gift and no shops open). I already love my Raiz App but this feature is the one I love the most, because I don’t necessarily need to shop online to receive my reward, I now purchase the e-vouchers through my Raiz app then use them like cash in store.

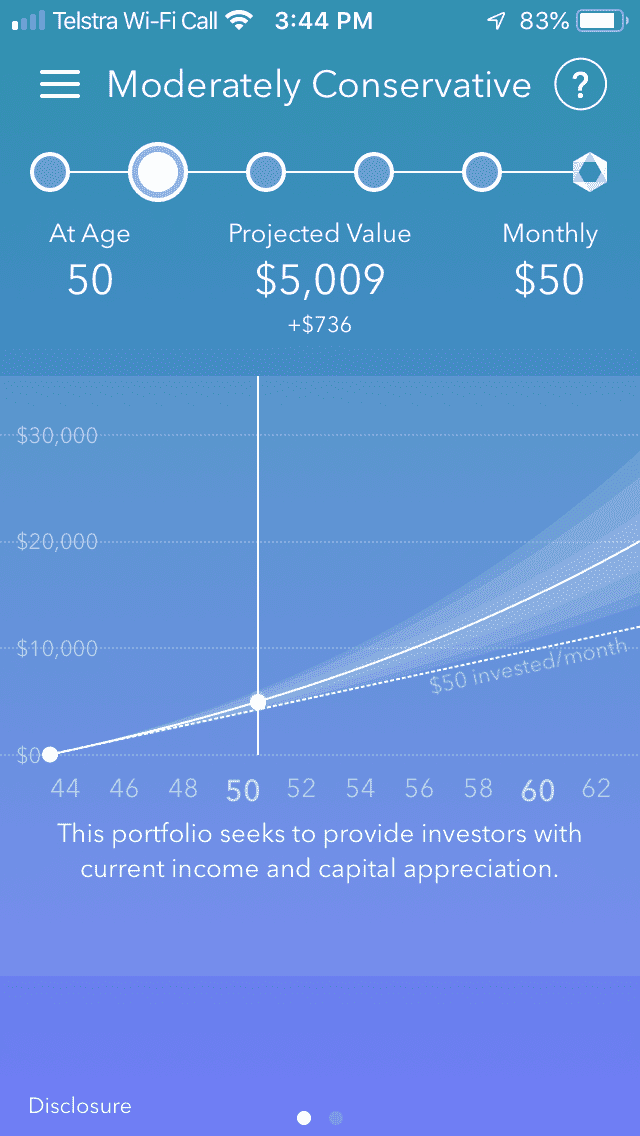

Raiz invests the money in my account accumulated from Raiz Rewards and round up deposits in a range of shares and bonds, and also re-invests the dividends from these investments. The average rate of return on the Raiz App is currently around 12%. This is however varies dependant on the level of risk you set your account to. You can choose to set your portfolio to a risk level from conservative to aggressive.

I can see the performance of my portfolio from the app and it updates daily from the history section. The history summary includes, how much I’ve invested, how many dividends have been re-invested, the market return on my investment, Raiz Rewards I’ve received and how much I’ve received from referrals.

What I love most is that my investment is fluid, I can take it out or add to it at any time. There is also the option to transfer my funds to the Raiz Kids Accounts I have set up within the app, that I can transfer to the kids when they are 18. I can change or stop the round ups at any time and stop or change automatic savings too.

The app features bank level security and nothing is stored on my phone. The app is pin number protected just like a banking app and my funds are insured against criminal activity including cyber crimes.

So what does it cost? Well the Raiz App is free. Once you’ve got $5 in your account (which Raiz will put in your account if you sign up using this link ) Raiz starts investing your account balance, and you only pay $2.50 per month (or 0.275% per year on accounts over $10,000) for the service of your automatic round ups and management of the investment of your account balance.

Not sure? Download the Raiz App from the App Store or Google Play today, it’s free to download and have a look around at all the features and to browse the reward partners. If you use this link they’ll kick off your account with $5 so you can start micro investing straight away. I personally love that I am using my spare change and money back on things I spend on anyway to be invested in building a nest egg for the future or to use to go on a family holiday in the future.

If all those savings, cash back and investment incentives weren’t enough, then show your friends, share with them using the link in your app and when they sign up, you get $5.00 into your Raiz Account and so do they! If you’ve always wanted to get into investing but haven’t had the money, or perhaps you are looking for a way to save for something special micro investing and saving with Raiz may just be for you.

To find out more about the Raiz App head to www.raizinvest.com.au

We make every effort to ensure all this information is up to date but should be used as a guide only. Events do get cancelled or changed and venues can close without notice. Always follow the links provided for up to date information on an event or activity. If you know of a change or cancellation we’ve missed then please contact us to let us know.